Payment apps are everywhere—from splitting a restaurant bill to paying a mortgage. Digital payments are now a part of daily life, and this trend is only speeding up. Indeed, embedded payment transaction values are expected to reach over $2.5 trillion worldwide by 2028.

For fintech companies and startups, though, building a new payment app is not an easy task. Regulation changes, security threats evolve, consumers expect smooth experiences, and competition is aggressive. Despite all this, development teams tend to hit the same obstacles—some technical, some regulatory, and many based on a single, perilous assumption.

Let’s dive into these issues, why they exist, and how companies are rethinking their payment app development strategy in the US market.

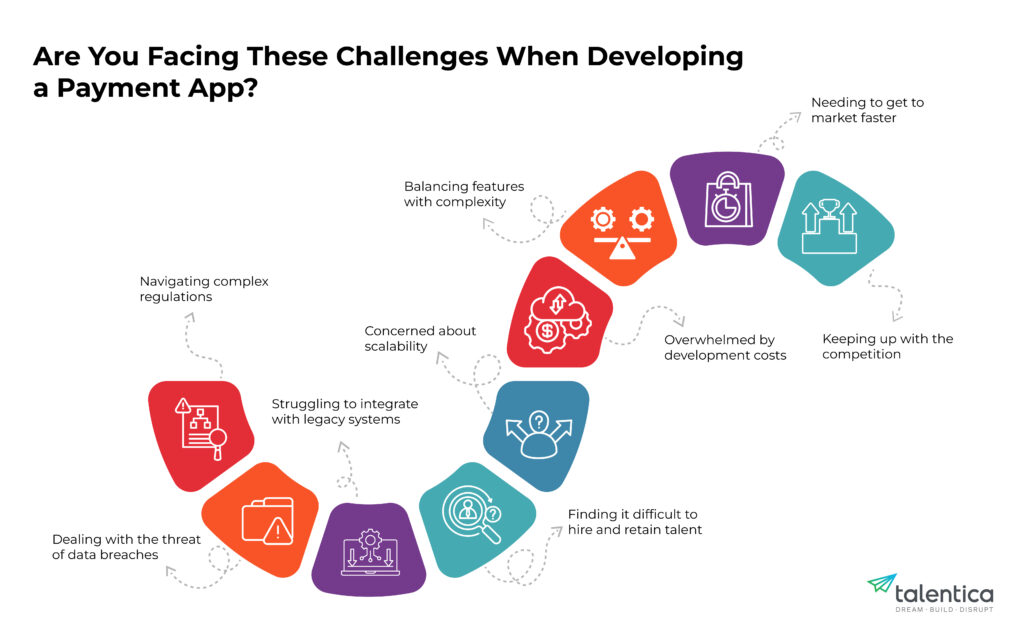

Are you encountering these challenges when developing a payment app?

Some challenges are expected in payment app development, but that doesn’t make them any less difficult to overcome. As a system becomes more complex, every moving element is at risk of failing if not handled properly. Let’s look at them.

Regulatory compliance and global integration

In payments, compliance is not a choice—it’s the price of admission. In the US, payment app development has to comply with an army of federal and state regulations. PCI DSS, CCPA, FFIEC, AML, KYC…the list goes on, and non-compliance is expensive. A single violation of PCI DSS can lead to fines up to $500,000 per incident.

And it’s not only about US regulations. If the app supports cross-border transactions, compliance complexity compounds—with PSD2 in the European Union, the Payment Services Act in Japan, and dozens more adds another layer of difficulties.

Many fintechs find it difficult and time-consuming to comply with these requirements. Compliance is not a static activity, but a dynamic process. A system that can work with today’s regulations will be obsolete tomorrow, and thus needs constant auditing, documentation, and the capability to adjust to evolving rules. Based on the latest data, 93% of fintechs struggle to meet regulatory standards, highlighting the difficulty of being compliant in an ever-changing environment.

Data privacy and security breaches

Fraud is a $10 billion problem in the US alone. Payment apps are relentlessly attacked—credential stuffing, phishing, API abuse, synthetic identities. In 2024, the mean cost of a data breach increased by 10%.

Multi-factor authentication (MFA) and encryption protocols are no longer sufficient. Real-time anomaly detection, biometric verification, and fraud-detection AI models are becoming the new norm. Yet, implementing these features without adding friction to the user experience remains one of the toughest balancing acts in payment app development.

Technology integration with legacy systems

Not every financial system is built from scratch. Quite a few banks and financial institutions still rely on decades-old mainframes, and integrating modern payment applications with these legacy infrastructures is a challenge that refuses to go away.

Take, for example, a payment application that must integrate smoothly with the backend system of a bank in order to execute real-time transactions. If that backend system was developed prior to the advent of cloud computing, the integration becomes an exercise in retrofitting old equipment with new components—usually resulting in data silos, delayed transactions, and compatibility nightmares.

Talent Scarcity and retention

Good fintech engineers are hard to find. Keeping them? Even harder. The need for engineers with blockchain, security, AI-based fraud detection, and compliance expertise has grown by 18% in 2024, the Bureau of Labor Statistics says. Consequently, fintech startups are usually presented with a dilemma: Do they create an in-house team or outsource critical components?

There is no one-size-fits-all solution, but one trend is surfacing—a hybrid model. Firms are retaining core decision-making in-house while strategically outsourcing high-skill, high-risk elements such as security, compliance management, and AI model training to experienced startup product development company.

Scalability issues

A payment app that performs well under regular traffic can fail under sudden 10x traffic spike on Black Friday or an unexpected viral moment. Scalability is not merely a matter of throwing more server space at the problem; it’s about providing transparent load balancing, auto-scaling infrastructure, and decentralized processing—without introducing latency problems

41% of the Latin America and the Caribbean fintech start-ups have marked scalability as the major challenge. Many noted that lack of planning for scaling caused downtime, poor customer experience, and in most cases, customer losses to more reliable alternative.

High development cost

Building a secure and feature-packed payment app in the USA is capital-intensive. Aside from upfront development, constant operational costs for security patches, compliance checks, and customer care can be a huge overhead.

Striking a balance between these costs and a high-quality product is an ongoing challenge.

Balancing features and complexity

A successful payment app should provide a rich feature set—like digital wallets, real-time transaction monitoring, and multi-factor authentication—while still being easy to use. Adding too many features to the app can result in performance degradation and create vulnerabilities, while an overly minimalist approach may fall short of user expectations.

The challenge is finding the right balance between innovation and usability, making the app competitive and secure.

Time-to-market

Speed matters. A 6-month lag can equate to losing a key market opportunity. Competitors are quick, and user expectations change even quicker.

The challenge? Rushing development often means technical debt, compliance gaps, and security flaws. But over-engineering causes paralysis, delaying launch indefinitely. Speed-to-market isn’t merely a competitive edge—it’s a necessity in an environment where consumer attitudes are changing rapidly. Finding the right balance is everything.

Competition and user retention

The US market has a number of established payment platforms such as PayPal, Venmo, and Square. Entering this competitive arena means not only acquiring users but also ensuring their long-term loyalty.

The typical cost of customer acquisition (CAC) for fintech apps has increased over the past two years. Customers have more options than ever before, and if your app isn’t engaging from day one, they’ll delete it. Retention is not merely about providing awesome features—it’s about providing a frictionless experience:

- Rapid onboarding

- Real-time transactions

- Proactive fraud protection

Failing to meet these high expectations can result in a rapid loss of market traction. Finding that balance is what will help create a competitive product.

Overcoming challenges through strategic outsourcing

Not everything needs to be done in-house. As fintech becomes more complicated, firms are realizing that attempting to do it all themselves holds back development. Indeed, some of the most successful fintech firms outsource critical aspects—regulatory compliance, security audits, bank integrations—while retaining core innovation in-house.

Why? Because speed counts. Expertise counts. Cost effectiveness counts.

Outsourcing payment app development can offer several benefits:

- A devoted partner with dedicated knowledge of US financial regulations is able to guarantee that your application complies with all the necessary legal standards.

- By utilizing a partner’s experience of advanced security features, such as real-time protection and encryption, the risk of data breaches will be dramatically lower.

- Qualified development teams understand how to interact contemporary solutions with legacy systems so that the process of integration will be smoother.

- Outsourcing enables access to more talent pool in a wider base, reducing pains around the limitations and retention of internal experts.

- The outsourcing partner will have the expertise to architect systems for scalability that handle both steady growth and peak usage periods.

- Eliminating repetitive effort through outsourcing has the effect of saving both time to market and total expense, making outsourcing a good alternative for most firms.

Outsourcing isn’t about relinquishing control—it’s about strategically offloading complexity so teams can concentrate on differentiation, not execution.

Consider, for instance, a fintech company that wants to create a mobile-first digital wallet with real-time transaction tracking, AI-driven fraud detection, and biometric login. Rather than developing each component in-house, they chose a strategic mix of in-house expertise and outsourcing.

Their internal team handled core product strategy and user experience, while engaging with a professional software development company to handle tricky technical implementation, such as security and compliance. This wasn’t only cost effective for them to do upfront on development costs; it also resulted in their product launch being easier, quicker, and more secure. By taking advantage of the development company’s expertise in creating secure and compliant payment products, the startup minimized their risk of expensive security breaches and compliance infractions in the future.

How much does it cost to build a payment app?

Although precise figures differ, the true cost of payment app development is not merely engineering hours—it’s the long-term expense of compliance, security breaches, and downtime.

Let’s have a look over a number of key elements that contribute to cost to develop a payment app:

Design complexity

A basic, simple design that focuses on core functions will always be more cost-effective than a highly customized, visually complex interface with various animations and interactive features. Carefully consider user experience; while a clean design is crucial, prioritizing usability and a streamlined flow can help save money.

Feature set

The number and complexity of features has a direct influence on development time and costs. A simple digital wallet with basic sending and receiving features will cost less than feature-rich software with spending analytics, bill payment, incentive programs, or connection to numerous financial institutions. Prioritize features based on customer needs and market demand, starting with a minimum viable product (MVP) and iterating in response to user feedback.

Security

Implementing strong security measures is essential for a payment app, but it increases the cost. This includes secure coding techniques, data encryption, multi-factor authentication, vulnerability assessments, penetration testing, and continuous security monitoring. The level of security required is determined by the sensitivity of the data being handled, as well as legislative restrictions. Investing in security is critical to avoiding potentially disastrous financial and reputational consequences from data breaches.

Compliance

Complying with regulatory standards (KYC/AML, data protection legislation such as CCPA/CPRA, and PCI DSS for payment processing) involves considerable costs. Compliance requires legal guidance, audits, the implementation of required procedures, and regular monitoring. Non-compliance can result in significant legal consequences and penalties. Integrating compliance into the development process from the beginning can be more efficient and cost-effective than trying to implement it later.

Each of these factors affects the overall cost of developing a payment app. More complex designs and features, robust security, and full compliance all contribute to higher costs. Before you start with payment app development, it’s critical to carefully consider these aspects and create a reasonable budget.

Remember that the cheapest option may not be the most cost-effective in the long run if it leads to security vulnerabilities or compliance issues.

Essential features of payment app

A robust payments app should offer a set of features aimed at improving user experience and maintaining operational efficiency. The table below highlights the key functionalities expected in a modern payment app:

| Feature | Description |

| Digital wallet | Secure storage and management of digital currencies and payment credentials. |

| Send and receive money | Seamless money transfers between users, complete with real-time notifications and tracking. |

| Spending analytics | Detailed insights into spending habits to help users manage their finances effectively. |

| Notification | Real-time alerts for transactions, security updates, and important communications. |

| Payment and invoicing | Tools for processing payments, generating invoices, and managing billing cycles. |

| Transaction history | Detailed logs of past transactions for transparency and record-keeping. |

| Multi-factor authentication | Enhanced security through additional layers of identity verification. |

| Transfer | Ability to move funds between accounts, both domestically and internationally. |

| Banking integration | Seamless connection with traditional banking systems for streamlined funds management. |

| Biometric identification | Use of fingerprint or facial recognition for secure access and transactions. |

| Text messaging | SMS notifications and communication channels for timely updates and support. |

| Customer support | In-app support features, including live chat, FAQs, and ticketing systems to assist users. |

Conclusion

The fintech revolution is revolutionizing the way payments are done, but the hurdles to payment app development in the USA aren’t going away anytime soon. Regulations will keep changing, security threats will become more cunning, and expectations from users will increase.

But the winners will be the ones that stick to what they do best—and outsource the rest to specialized partners who can deliver compliance, security, and scalability at speed.

Because in the end, the goal isn’t just to build a payments app. It’s to build trust.