Generative AI (GenAI) is a very promising tool for the financial sector, offering unprecedented levels of creativity, prediction, and automation at a scale never seen before. A recent McKinsey report found that 90% of financial institutions have, to some degree, a centralized Gen AI function in their infrastructure. These figures are on an upward trend too.

Despite its widespread adoption, many fintech companies are still unable to fully leverage GenAI’s transformative potential. The shortfall is in its strategic implementation and integration. In this article, we will look at the practical uses of Generative AI in FinTech, analyze its effects across seven major areas, and provide best practices for implementing it.

Key FinTech areas where generative AI is creating business value

Although there are many usecases for generative AI, fintechs can benefit most immediately from these:

Enhancing customer engagement

Fintechs have traditionally used basic chatbots, but GenAI greatly improves their abilities. Instead of pre-programmed responses, GenAI-powered chatbots and virtual assistants can provide dynamic, contextual conversations that feel very human.

By examining transactional behavior, consumer spending, and other context data, these GenAI assistants can provide highly relevant, personalized product recommendations and responses. This may include providing advice on managing debt or suggesting a new investment option. These GenAI-powered assistants learn and evolve over time to match the evolving needs of each individual consumer, resulting in hyper personalization and more substantial interactions.

For example, if a high-net-worth investor asks a banking chatbot, “Given the Federal Reserve’s recent interest rate hike, what is the best decision for my portfolio?” a conversational AI chatbot can pull up generic market responses. However, using the user’s portfolio structure, risk tolerance, and past market responses, a GenAI-powered chatbot can produce personalized investment analysis.

Business Impact:

- 24/7 real-time GenAI-backed customer service

- Higher personalization levels for financial guidance services

- Cost reduction through minimized use of human agents

Transforming knowledge management

Financial institutions are complex businesses with huge volumes of data stored in policies, reports, and past transactions. Quickly locating relevant information has never been easy.

Generative AI, which powers “supercharged” knowledge centers, is changing this. These generative artificial intelligence (AI)-powered solutions act as internal search assistants, allowing employees to ask questions in simple language and receive accurate answers about compliance requirements, market trends, or internal processes.

Business Impact:

- Faster decision-making across departments

- Better cooperation and information sharing

- Less reliance on outdated manual search procedures

Scaling financial content creation

Personalized communication is critical to fostering solid relationships with financial customers. Yet, tailoring content specifically for each customer is time taking and difficult to scale. Generative AI has made it possible for fintech companies to efficiently deliver highly personalized, engaging multimedia experiences.

Fintech companies can now automatically create investor newsletters, product explainer videos, and even audio descriptions of market fluctuations instead of general market updates. For example, a customer can receive personalized advice and a short video message describing how recent market fluctuations can affect their specific investment.

Generative AI makes it possible to extend this level of individualized communication, improving the overall customer experience. Companies like Synthesia is using GenAI to produce high-quality AI-generated voiceovers and videos for financial audiences, ensuring greater engagement without the need for labor-intensive content creation.

Business benefits:

- More customer loyalty with personalized interactions

- Reduced cost of operations with automated advisory and engagement processes

- Higher fintech product conversion rates through data-driven personalization

Improving data-driven decision-making

Financial services are data-driven in nature, and with the increased growth of generative AI, businesses now get access to more detailed and comprehensive insights that can enable them to make improved business decisions. For instance, generative AI is transforming how fintech businesses and banks analyze transaction information, identify patterns in customer behavior, and forecast market trends.

The real worth of genAI is in its capacity to handle massive volumes of unstructured data and deliver actionable information. Generative AI enables fintech companies to offer more specialized services by supplementing raw transaction data with contextual information, such as merchant identity, payment processor, and transaction categories.

This improved data quality enables decision-makers to better analyze risks, customize products, and identify new business opportunities. Financial organizations can also use genAI to improve the accuracy and agility of their strategies to remain competitive in a rapidly evolving market.

Business benefits:

- Smarter, more informed decisions

- Enhanced, personalized services

- Increased agility and responsiveness to market changes

Advancing trading and portfolio management

While algorithmic trading has been around for a while, GenAI goes further. GenAI can create dynamic trading strategies instead of relying on pre-established sets of rules, detecting opportunities in the market in real-time that traditional models would miss.

For example, LTX by Broadridge introduced BondGPT, a generative AI bond assistant. Using a conversational interface, BondGPT, powered by OpenAI’s GPT-4, enables users to query bonds and find corporate bonds according to predetermined standards. BondGPT provides improved liquidity discovery and pricing assistance to asset managers, hedge funds, and brokers by streamlining bond selection and portfolio construction through the integration of real-time liquidity data with advanced bond similarity technologies.

This AI-powered support is not limited to bonds. Such solutions are on the rise for equities, derivatives, and even alternatives, allowing traders to make better choices and streamline portfolio performance.

Furthermore, real-time transaction data, historical asset correlations, and global economic indicators can be continuously analyzed by generative AI models to produce portfolio allocations that automatically adjust in response to market movements. This strategy optimizes portfolio efficiency while simultaneously reducing human bias.

Business Benefits:

- Faster market reaction times using AI-powered insights

- Stronger risk-adjusted returns with dynamically created portfolio allocations

- Reduced research overhead through automated investment analysis

Strengthening forecasting and scenario planning

GenAI’s predictive analytics go beyond the current state of the market. Financial institutions are now using these models to anticipate future events, helping them anticipate potential dangers and possibilities. Decision makers can assess the effects of different economic situations on their capital allocation, lending strategies, and portfolios by creating a series of “what-if” scenarios.

For example, a mid-sized bank can use GenAI to simulate the impact of interest rate changes on its loan portfolio. The GenAI system makes predictions taking into account past performance, current market conditions, and emerging trends. As a result, the bank can more efficiently balance risk and opportunity by proactively modifying its lending criteria.

Business Benefits:

- Faster strategic pivots based on real-time insights

- Premature risk discovery through predictive modelling

- Intelligent resource management for highest returns

Enhancing deepfake detection & secure transaction

In January 2024, deepfake technology was used to impersonate the CFO of a Hong Kong-based corporation during a video conference, tricking an employee into handing over $25 million to fraudsters. This case highlights the growing danger of complex deepfakes, synthetic identities, and AI-created fakes. Fintech companies must combine AI-powered protections with AI-powered attacks.

GenAI-powered security solutions, such as those offered by Reality Defender, enable real-time detection of AI-generated deepfake fraud attempts. This is crucial to preventing synthetic identity fraud, when fraudsters use AI-generated characters to establish fake identities. GenAI’s ability to scan large amounts of data and detect anomalies makes it an essential tool for detecting potential security breaches before they get worse.

Business benefits

- Real-time deepfake detection minimizing financial loss

- Preventing security violations safeguards the reputation of the company and prevents bad publicity

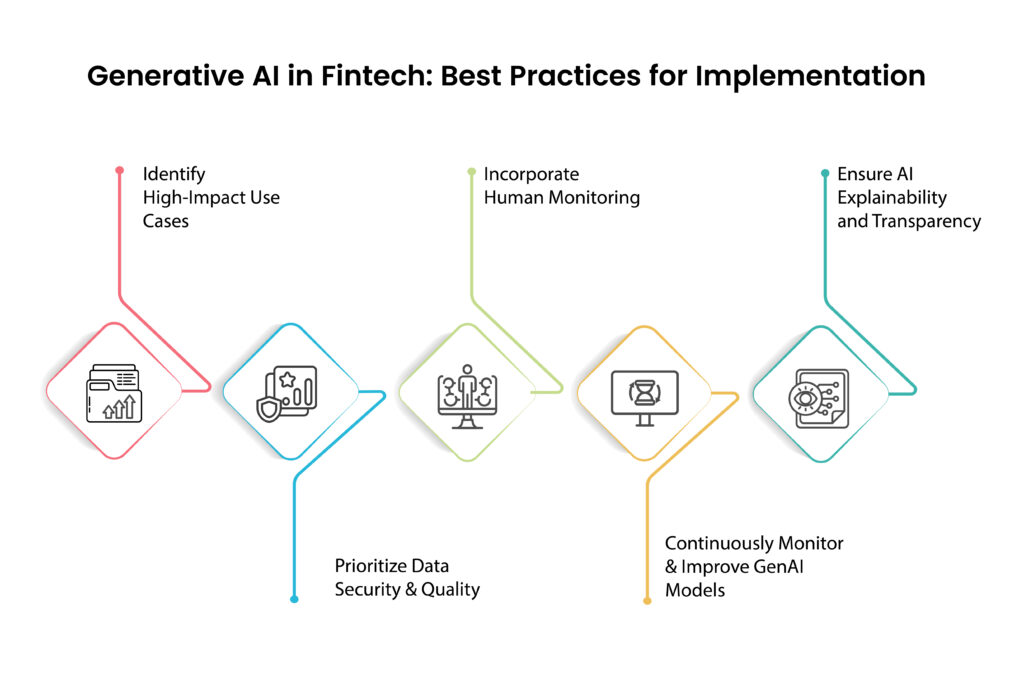

Best practices for implementing generative ai in fintech

While GenAI offers exciting possibilities, its effective adoption requires a well-defined plan. To optimize business value, fintech executives must focus on:

Identify high impact use case

Fintech CEOs should focus on high-impact use cases that generate the most business value rather than spreading resources thinly. To optimize ROI and drive meaningful change, concentrate on areas such as business processes, fraud prevention, compliance automation, and customer engagement.

Prioritize data security and quality

Data accuracy determines the success of GenAI. To maintain security, put in place strong data governance policies, encryption, and confidential computing solutions.By encrypting data while it is being used, as well as when it is in transit and at rest, confidential computing improves data security. As a result, even cloud providers cannot see or access the processed data. This is crucial to maintain regulatory compliance and protect privacy when developing and deploying machine learning models that use private or sensitive financial data.

Include human monitoring

GenAI should complement human decision-making, not replace it. Verify GenAI-generated insights using human-involved models before deployment.

Constantly monitor and improve GenAI models

GenAI models should change as financial markets change. Retrain GenAI models on current financial data on a regular basis to ensure accuracy and applicability.

Ensure AI is explainable and transparent

Implement explainable AI (XAI) frameworks to preserve consumer trust and ensure compliance with legislation. This encourages safe use and increases trust in GenAI-based insights. Transparency is essential for both practical application and ethical issues.

Conclusion

The promise of generative AI in FinTech is vast. It is transforming the financial services industry in a number of ways, from improving customer service and predictive analytics to increasing operational efficiency and strengthening security protocols. But, as with any disruptive technology, decision-makers must take a strategic approach to responsible Generative AI implementation, ensuring it aligns with their business objectives and complies with legal requirements.

To achieve this, it is necessary to invest in the right generative ai tech stack and the skills required to make the most of it. Whether by developing in-house expertise or through collaborations with external experts, acquiring the right skill set is essential to managing the complexity of GenAI. Adopting a strategic, talent-focused approach can help fintech companies leverage GenAI and establish a competitive advantage in the changing financial sector.