Fintech software development relies heavily on speed, security, and scalability, but these factors are also its biggest hurdles. A payments platform that is delayed by even a fraction of a second can cost millions. A lending algorithm that miscalculates risk can bring down entire portfolios. A digital wallet that is not airtight against fraud is a lawsuit waiting to happen. In fintech, there is no room for “good enough.” Systems must be fast, resilient, and secure — not in theory, but in execution.

The fintech software market is growing, which is not surprising. With a compound annual growth rate (CAGR) of 5.7%, it is projected to increase from its 2023 valuation of $48.2 billion to $71 billion by 2030. However, the growth is not only because of market hunger but also because of the increasing level of expertise required in order to create modern yet compliant financial systems.

Fintech is not just about coding; it is about engineering trust, designing seamless user experiences, and making sure every transaction holds up under scrutiny. This is where many stumble. Legacy infrastructure resists innovation. Regulatory frameworks change faster than product roadmaps. AI-based risk models claim precision but can only be as good as the data fed to them. The challenge is not just how to develop financial software, but how to do it right.

In this guide, we dissect fintech software development from three angles: the technical, the functional, and the business. In addition to these important considerations, we’ll discuss the important stages of the development process, explore various development options (in-house, outsourced, or hybrid), discuss the importance of choosing the right development partner and provide guidance on how to keep development costs under control.

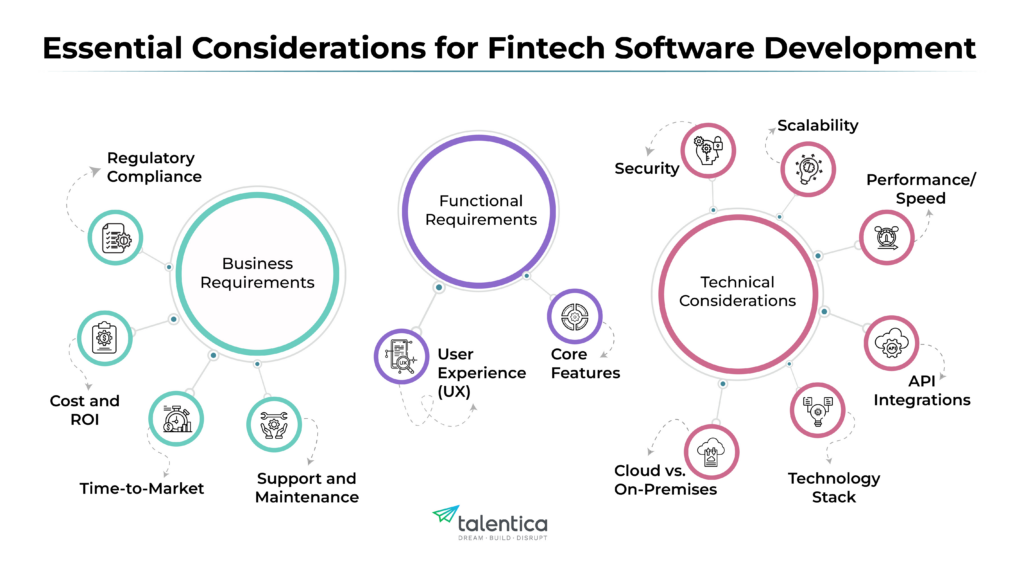

Essential considerations for fintech software development

Fintech software development involves more than just building an app or platform. Its success in terms of consumer acceptance, security, and scalability is determined by the decisions you make during development.

Therefore, before you start developing fintech software, it is critical to carefully evaluate the following considerations:

Technical considerations

Security

Security is always a top priority in fintech software development, since the financial sector remains a prime target for hackers/cyberattacks. Protecting users’ money, personal information, and platform integrity is critical to building trust and maintaining long-term success. A breach can have disastrous consequences, including financial loss, reputational damage, and legal ramifications. To prevent breaches and protect sensitive data, implementing strong security measures is critical. Without strong security measures, it is difficult to gain user trust and regulatory fines are inevitable.

Financial data such as account balances, transaction history, and personally identifiable information (PII) must be protected both in transit and at rest. This involves adopting strong encryption technologies and effective key management processes.

In addition, developers must be diligent in protecting against typical vulnerabilities such as SQL injection and cross-site scripting, which can expose sensitive data to attackers. Secure coding methods, frequent vulnerability assessments, and penetration testing are critical instruments in this effort.

Authentication and authorization are also important. Fintech platforms should ensure that only authorized users have access to their accounts and conduct transactions. Multi-factor authentication (MFA) should be required as an additional layer of protection beyond passwords. For example, a fintech firm can use MFA to require customers to provide a one-time code assigned to their mobile device in addition to their password when logging in. This extra step helps prevent unwanted access even if a user’s password has been hacked.

Biometric identification, such as fingerprint or facial recognition, can increase security and improve user experience. A least-privilege model should be enforced, providing users with only the capabilities they need to fulfill their responsibilities.

API security is another important aspect. Fintech applications often use APIs to interact with other systems, such as banks, payment processors, and third-party services. These APIs must be protected with strong authentication and authorization techniques, as well as protection against API-specific threats. Regular security audits and API penetration testing are critical to identifying and addressing any issues.

If you want to integrate AI into fintech software applications, take even stricter data privacy protection measures. Methods like differential privacy can ensure that data remains protected even within AI models.

Learn more about how AI is transforming the fintech industry in our detailed guide on AI in Fintech

In addition to technological solutions, a strong security culture is essential. Training on security best practices should be provided to all team members involved in building and maintaining the fintech platform. Phishing attacks, social engineering, and other typical security hazards can be avoided with regular security awareness training.

To minimize damage and ensure business continuity, incident response procedures must be implemented to handle security incidents in a timely and efficient manner. To identify and address unusual activity, security systems and logs must be continuously monitored.

Fintech security is an ongoing process that requires constant attention to detail and adjustments to changing threats.

Scalability

Scalability is another important technical aspect in fintech software development. Fintech applications must be designed to accommodate rapid growth in transaction volume and user base.

Scalability is not an afterthought; it must be built into the design from the beginning. Microservices architecture, cloud-native technologies, and containerization can offer horizontal scalability, allowing the application to respond to increasing demand. Load balancing distributes traffic across numerous servers to prevent bottlenecks and provide high availability. Long-term scalability also requires selecting the right database technology capable of handling massive data sets and high transaction throughput.

For instance, consider a mobile payment application that initially processes a few thousand transactions per day. If that application suddenly becomes popular and starts processing millions of transactions per day, a monolithic architecture may struggle to keep up, resulting in slowdowns or crashes. However, a microservices architecture would allow the payment processing component to be scaled separately, ensuring that it runs smoothly even under heavy loads.

Performance/Speed

Performance is another important factor in fintech software development. Users demand fast transaction processing, low latency, and a seamless experience. Slow loading times or sluggish performance can lead to customer irritation, transaction abandonment, and ultimately hurt your brand image. To reduce latency in a financial application, consider optimizing database queries, efficient algorithms, and caching strategies.

Real-time data processing is often required, particularly for applications involving trading or payments. Performance testing throughout the development cycle is critical to identify and address bottlenecks early on. Additionally, robust monitoring tools should be added post-launch to continuously track performance and ensure app responsiveness and reliability, especially during high loads. A high-performing fintech app not only improves user satisfaction but also helps build trust and credibility when dealing with financial transactions.

API integrations

Fintech applications rarely operate in isolation. They often need to communicate with existing financial systems, third-party services such as payment gateways and KYC/AML providers, and banking APIs.

Well-documented APIs that comply with industry standards, such as open banking APIs, are critical to supporting these interactions.

A robust API approach not only facilitates connectivity, but also fosters interoperability and extensibility, allowing the application to adapt to future demands and interact with new services as they are developed. This interconnection provides a more comprehensive user experience, combining numerous financial services into a single, simple platform.

Technology stack

The success of a fintech project critically depends on the choice of technology stack. Project goals, scalability requirements, development team skills, and security concerns influence the selection of programming languages, frameworks, and databases.

For the front end, React, Angular, and Vue.js are popular choices for creating modern, interactive user interfaces. For back-end development Java, Python, or Go offers its own set of strengths. Frameworks such as Spring Boot (Java) and Node.js (JavaScript) further streamline the development process. When it comes to databases, consider PostgreSQL for relational data and MongoDB for flexible, schema-less storage.

However, a number of factors, including project needs, team skills, and desired features, often influence technology selection. So, it is critical to select technologies that are up-to-date and show signs of long-term viability. This ensures that the software is constantly up-to-date and controllable, making future upgrades and modifications easier.

Cloud vs. On-premises

It is critical to evaluate the benefits and drawbacks of both cloud infrastructure (AWS, Azure, GCP) and on-premises infrastructure. Cloud solutions provide scalability, cost-effectiveness (pay-as-you-go), and lower maintenance costs.

On-premises infrastructure gives you more control over your data and security but is more expensive and requires significant upfront commitment. Many fintech organizations can also benefit from a hybrid strategy, which combines the best of both. Consider data sovereignty, regulatory compliance, and security considerations when making this selection.

Functional requirements

Core features

Core functionality is more than just a list of features; it represents the essence of what your financial app does. It’s about the problem you’re addressing for your customers and the value you’re delivering. The first step is to clearly define these core features. Are you developing a payment processing platform, a lending marketplace, an investment management tool, or a personal financial manager app? Each requires a unique set of core functionalities.

For example, if you are developing a mobile payment app, core functionality may include seamless transactions, strong security, and connectivity to numerous payment methods. A lending platform may benefit from streamlined loan applications, automatic approvals, and secure cash delivery. The goal is to define the unique value proposition and prioritize the elements that successfully fulfill it.

Don’t try to build everything at once. Focus on the most important features for your first release and gradually scale up from there. This will allow you to launch your product faster, get customer feedback, and iterate based on real-world usage. A minimum viable product (MVP) strategy is often recommended, with an emphasis on key capabilities that provide the most value to early adopters.

Also Read: 8-Step Minimum Viable Product Checklist for Developing a Successful Startup Product

User experience (UX)

User experience (UX) in fintech goes far beyond aesthetics; it is at the core of how people interact with and perceive your financial product. A study by The Financial Brand found that 73% of people would switch banks for a better digital experience.

It’s not just about having a visually appealing design; it’s about providing a seamless, simple, and reliable experience that allows people to manage their funds efficiently. A well-designed UX ensures a more efficient workflow.

Consider a person trying to transfer funds using a mobile banking app. A cluttered user interface, confusing navigation, or slow loading times can lead to irritation and, eventually, abandonment. In contrast, a simplified process with clear instructions and quick confirmation builds trust and encourages repeat use.

This is why thorough user research is essential. Understanding user behavior, needs, and pain points is key to creating an engaging experience. Creating user profiles, designing user flows, and conducting usability testing are all necessary.

Accessibility is another important feature of user experience in fintech. Financial services should be accessible to everyone, regardless of their abilities. This involves creating applications that are accessible to people with disabilities. Inclusive design not only helps users with disabilities but also improves the usability of the application for everyone. For example, clear and simple language helps all users, not just those with cognitive disabilities.

Personalization also plays an important role in improving the user experience. Users want individualized experiences that are tailored to their financial situation and particular ambitions. This can include offering personalized financial advice, suggesting suitable products or services, or providing individualized information about spending habits.

Personalization relies heavily on data analysis. Analyzing user data allows the software to anticipate requirements, offer proactive suggestions, and provide a more engaging and meaningful experience.

Business requirements

In addition to functional requirements, several business considerations should also be considered during fintech software development.

Regulatory compliance

Alloy, the identity risk management company, survey shows that 60% of fintech companies report paying at least $250,000 in compliance fines, with one-third paying over $500,000. Regulatory compliance is a critical aspect of fintech software development. By adhering to industry standards, developers ensure the secure and ethical handling of financial information, building user trust and mitigating the risk of legal repercussions. Addressing these requirements early in the development lifecycle is key to avoiding costly modifications and ensuring the software meets all legal obligations.

Fintech companies operating in the USA and beyond must adhere to numerous regulatory frameworks. Here are a list of some important compliance standards:

| Bank Secrecy Act (BSA) | Mandates Anti-Money Laundering (AML) measures to prevent financial crimes. |

| Dodd-Frank Act | It focuses on financial transparency and consumer protection. |

| Payment Card Industry Data Security Standard (PCI DSS) | Controls the secure processing of payment card information. |

| Gramm-Leach-Bliley Act (GLBA) | Ensures the security of customer financial information. |

| General Data Protection Regulation (GDPR) | Governs data protection for firms that work with EU residents’ data. |

| California Consumer Privacy Act (CCPA) | Focuses on data privacy for Californians. |

| Fair Credit Reporting Act (FCRA) | Controls how consumer credit information is handled. |

| Oxley Act (SOX) | Imposes compliance obligations for publicly traded. |

Ensuring compliance with these standards is crucial for fintech companies. For a detailed checklist on meeting key regulatory requirements, check out our Fintech Compliance Checklist.

Cost and ROI

Fintech projects require significant investment. Development costs (which can vary significantly depending on complexity, features, and location of the development team) need to be fully understood.

Equally important is deciding how the return on investment (ROI) will be monitored. Will it be through increased transaction volume, cheaper operational costs (such as automated KYC/AML checks), or new revenue streams (e.g. premium features)?

For example, developing a mobile payment app may require significant upfront costs, but ROI could be achieved through transaction fees and increased user engagement.

Time-to-market

Time to market is another important factor to consider during fintech software development. The fintech industry is constantly changing and being the first or earliest to market can provide a significant competitive advantage. It is essential to have a well-defined growth strategy with achievable timelines.

Delays can lead to missed opportunities and a loss of competitive advantage. Consider the case of a startup creating a new lending platform. A shorter time to market allows it to attract early adopters and gain traction before competitors emerge.

For example, one of our clients, a leading digital fintech platform, had a great opportunity to develop and launch a new technology product to meet growing market demand. However, they were faced with tight deadlines and a limited engineering team.

We streamlined their processes, filled skills gaps with our expert engineers, and fostered seamless collaboration to overcome these challenges. The result? A successful launch of their entire product in just 5 months! Read the full success story here!

Support and maintenance

Fintech software frequently handles sensitive financial information, requiring regular security updates, bug fixes, and technical support. A solid maintenance strategy ensures that the software remains secure, reliable, and compliant with changing laws.

For example, a trading platform requires constant maintenance to manage market changes, preserve data integrity, and fix any technological issues that may impact users’ financial activity. Failing to address these issues can lead to security risks, consumer dissatisfaction, and regulatory fines. Consider including ongoing maintenance and support costs in your original budget.

Key steps in fintech software development

Identify requirements and conduct market research

The initial stage in fintech software development is to conduct thorough market research and establish project’s particular requirements. This includes assessing target customers, recognizing market trends, and determining regulatory needs. Clear objectives must be developed to ensure that the program meets user demands and adheres to industry standards.

This step lays the foundations for a successful fintech software development process.

Architecture design

After determining the requirements, the next step in fintech software development process is building software architecture. This involves developing blueprints for user interfaces, data flow, and system integration. A well-thought-out design ensures that the financial application is scalable, efficient, and secure.

Selecting the right technology stack

Choosing the right technology stack is critical for fintech software development. Beyond speed, compatibility, and security, it is critical to assess scalability for future development, compliance with industry standards, and interaction with third-party services.

Additionally, the stack should facilitate rapid development, reduce maintenance costs, and ensure long-term reliability to meet changing business requirements. Choose tools and frameworks with strong community support to ensure that updates and troubleshooting are easily accessible.

Development and testing

The development process in fintech software development cycle begins when the requirements, UX/UI design, and technology stack have been defined.

This includes developing the code, integrating various software components, and testing to detect any defects or difficulties that may arise. Before releasing the software to users, it is essential to conduct thorough testing to verify its reliability and security.

Deployment

Following successful testing, the fintech software is deployed into a production environment, allowing users to access and use its functionalities.

This includes setting up servers, databases, and other necessary components, as well as verifying that the software is ready for public use. It is important to carefully monitor the deployment process in order to be able to handle any technical difficulties or user feedback

Ongoing maintenance and updates

Fintech software requires ongoing maintenance and updates to maintain security, compliance, and ease of use.

This includes troubleshooting, offering new features, and adapting to changing regulatory needs. A dedicated team should be established to offer ongoing support and maintenance for the software. Periodically reviewing user feedback can also help uncover areas for improvement and guide future updates.

To maximize the potential of your fintech software, consider implementing artificial intelligence.

Understanding the cost of development

Fintech software development involves a number of expenses. While project prices can vary considerably, recognizing the main areas of expenditure allows for more accurate ROI planning and estimates.

- Regulatory compliance costs: One of the biggest expenses in the fintech sector is regulatory compliance. Implementing certain features, conducting compliance audits, and consulting with legal counsel are all expenses required to comply with strict regulatory standards (KYC/AML, GDPR, PSD2, etc.). These expenses are necessary to avoid problems and maintain user trust.

- Security costs: Robust security procedures are needed to protect sensitive financial data. Expenses include multi-factor authentication, penetration testing, vulnerability assessments, encryption, secure key management, and ongoing security monitoring. Compromising security can have disastrous consequences for your finances and reputation.

- Initial development costs: It includes design (UI/UX, architecture), prototyping, development tools, and developer fees. These initial expenses provide the framework for a high-quality, secure, and compliant fintech software/product.

- Technology stack costs: Back-end and front-end technologies, databases, cloud infrastructure, and API integrations all impact expenses. For fintechs to manage sensitive data and financial transactions, the technology stack must be reliable, secure, and scalable. Consider the support costs and long-term maintainability of the technology you have selected.

- Integration costs: Fintech software often needs to integrate with pre-existing banking gateways, CRMs, banking systems, and other financial platforms. API development, maintenance, and ensuring a smooth data flow all contribute to integration costs.

- Maintenance and support costs: Ongoing maintenance (bug fixes, security updates, performance optimization), user support, and infrastructure maintenance all add to these costs. Regular maintenance is vital for reliability, security, and compliance.

- Scaling and upgrading costs: As your fintech business grows, your software must scale to handle increased numbers of users, transactions, and data. Costs associated with scaling infrastructure, adding new features, and upgrading the system must be anticipated.

- Hidden costs: Overhead project management costs, unforeseen technological difficulties, changing regulatory environments, and potential downtime can all lead to hidden costs. These unforeseen costs can be reduced through proactive problem resolution and contingency planning.

By carefully evaluating these cost areas, you can create a reasonable budget for your fintech software project and accurately estimate your ROI.

Consider development options: in-house, outsourced, or hybrid

When it comes to fintech software development, there are three main options: in-house, outsourced, or a hybrid strategy. Each offers advantages and disadvantages, which should be carefully considered based on your company’s needs and resources.

In-house development

In-house development gives you full control over the project, allowing you to create custom solutions that fit your company’s plan. However, assembling a team of professional experts with financial and technological skills can be costly and time-consuming. Additionally, maintaining an in-house staff incurs recurring expenses.

Outsourcing

Outsourcing software development allows you to access specialized skills at a more affordable price, potentially reducing development time. It also reduces overall costs by eliminating the need for full-time salary, benefits, and ongoing training.

For example, one of our clients, a California-based fintech company, was struggling to meet the growing demand for their digital mortgage platform. They teamed with us to expand their engineering team and streamline their processes.

Our middleware solution simplified integrations with banking systems, reducing onboarding times and increasing customer adoption. This successful collaboration enabled the fintech company to meet customer needs and stay on track with their product roadmap, paving the way to reach their next milestone. See the full success story here!

Hybrid

A hybrid approach combines the control of in-house development with the cost savings of outsourcing. This involves building a core in-house team and supplementing it with outsourced specialist staff as needed. This provides flexibility and scalability while keeping costs under control.

Before selecting a development option, consider your project’s budget, schedule, desired level of control, and required expertise. With careful consideration and preparation, you will be able to decide on the optimal method for your fintech software development requirements.

If you think outsourcing makes more sense for you then selecting the right development partner is critical to project success.

Also Read: 3 Steps to Hire an Offshore Software Development Team

Choosing the right development partner

Selecting the right development partner is critical to the success of any financial software project. Before making this vital decision, consider the following key factors:

Technological expertise

Look for a partner who has prior experience in fintech software development. They should have a deep understanding of the appropriate technologies, such as blockchain (if applicable), cloud platforms, secure coding methods, and API connections with financial institutions.

Ask them about their experience with technology unique to your project (e.g. payment gateways, KYC/AML solutions, trading platforms). Feel free to ask for case studies, portfolio examples, and technical documentation

Top talent

A development partner is only as effective as its team. Find out about the credentials and experience of the developers who will contribute to your project.

Look for a team comprised of senior engineers, security professionals, compliance experts, and UI/UX designers. A successful team should not only have technical expertise but should also have a deep understanding of the fintech industry.

Product mindset

Your partner should possess a product mindset in addition to technical competence. This indicates that they are committed to providing a solution that meets your users’ demands and generates business value, and that they are aware of the business goals underlying your project.

They should be proactive in making suggestions for improvements, providing strategic insights, and considering the long-term viability of your product. As a true extension of your team, a partner with a product focus will work closely with you throughout the development process.

Focus on innovation

The fintech industry is constantly changing. Your development partner should be dedicated to staying at the forefront of innovation. Look for a partner that invests in R&D, explores emerging technologies (like blockchain and artificial intelligence), and promotes innovative problem solving. You can create a novel solution that sets you apart from the competition with the help of a partner that focuses on innovation.

By carefully considering these factors, you can choose a development partner that has the technical expertise, business acumen, and innovative thinking needed to achieve your fintech goal.

Conclusion

Managing the complexities of fintech software development requires careful planning, a deep understanding of the regulatory environment, and a calculated execution strategy. Every stage is essential to success, from identifying key features and prioritizing security to selecting the best development partner and efficiently controlling expenses.

Remember that developing a successful fintech software/product involves more than just technology; it also involves knowing your target market, addressing their requirements, and developing a solution that builds trust and adds value. By prioritizing compliance, security, and user experience, you can develop a fintech platform that not only meets customer demands but also positions your business for long-term growth and innovation in the financial sector.