Fintech executives are under increasing regulatory scrutiny as the Consumer Financial Protection Bureau (CFPB) tightens regulation and the SEC steps up enforcement operations. Noncompliance carries significant penalties, including costly fines, loss of reputation, and in extreme situations, shutdowns.

According to American Banker Association 93% of fintechs find it challenging to meet compliance requirements. Regulatory frameworks change rapidly, and keeping up requires both technological sophistication and an unwavering commitment to data integrity. This blog looks at the most pressing fintech compliance issues in the US and explores how partnering with the right software development company can mitigate risk while accelerating growth.

What keeps fintech CEOs up at night

It is not just the sheer volume of regulations, but their dynamic nature. From federal agencies like the OCC and CFPB to state-level authorities, the U.S. regulatory environment is a maze that no fintech company can afford to ignore.

Following are the top fintech compliance issues that are keeping fintech leaders up all night:

Data security and privacy

Fintech data breaches are on the rise. The average cost of a data breach for the financial sector rose roughly 3% over the past year to $6.08 million.

With the spread of digital payments and open banking, fintech firms process massive amounts of sensitive customer data, making them lucrative targets for cyberattacks.

Since the U.S. Federal Trade Commission (FTC) fortified the safeguards rule of the Gramm-Leach-Bliley Act (GLBA), there are more significant penalties for breaches of data now. Institutions can be liable up to $100,000 per violation and the company’s officers can become personally liable too.

The U.S. Consumer Financial Protection Bureau (CFPB) has also finalized a rule to oversee digital wallets and payment apps, subjecting them to bank-like scrutiny to protect consumer data and prevent fraud.

And while financial data makes for a top choice among hacker targets, following rules is not merely a question of compliance now—it’s customer trust.

Actionable tips

- Implement a zero-trust architecture that verifies all users and devices.

- Conduct regular audits to ensure that you stay compliant with state-specific privacy regulations and the GLBA.

Collaborate with software development teams that have experience in integrating multi-factor authentication (MFA), advanced encryption techniques, and real-time threat detection.

KYC/AML compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are intended to prevent money laundering and other financial crimes, but for fintech companies, it can be an operational burden.

Under the U.S. Bank Secrecy Act, fintechs are required to check customers’ identities, track transactions, and file reports of suspicious transactions. Non-compliance can draw substantial fines – take the $140 million civil money penalty given to USAA Federal Saving Bank for non-compliance with the BSA act on March 22.

Piling on the pressure, the Financial Crimes Enforcement Network (FinCEN) has stepped up enforcement of AML rules in 2024. This implies that individuals who fail to abide by the rules have the genuine possibility of incurring fines of several million dollars. Identity verification is no longer a one-time, passive process, but an active requirement that demands constant vigilance.

Actionable tips

- Automate identity verification with AI-driven KYC technologies to enhance accuracy and speed.

- Implement real-time monitoring systems to identify unusual transactions.

- Make sure that vendors are adhering to Financial Crimes Enforcement Network (FinCEN) regulations

- Collaborate with developers who know how to integrate seamlessly real-time transaction monitoring and SAR into your financial platform.

Consumer protection laws

The Consumer Financial Protection Bureau (CFPB) is cracking down on unfair, deceptive, or abusive activities and practices (UDAAP). For fintech companies offering buy-now-pay-later (BNPL) or digital finance services, increased attention means that even small compliance breaches can lead to audits and public enforcement proceedings.

Actionable Tips:

- Integrate consumer protection compliance throughout the software product development lifecycle.

- Partner with software teams that are skilled at developing audit-ready systems for tracking customer conversations, consent, and dispute resolution.

Vendor risk management

Third-party vendors are a critical component of fintech ecosystems—but they also present compliance risks. The Office of the Comptroller of the Currency (OCC) mandates rigorous oversight of third-party providers, holding fintech firms accountable for vendor misconduct.

In a 2024 SecurityScorecard Threat Intel Report, 97% of Top U.S. Banks were affected by third-party data breaches. This highlightes the critical need for robust vendor risk management.

Actionable tips:

- Perform extensive due diligence on all third-party providers.

- Require vendors to undergo regular SOC 2 audits and provide detailed compliance reports.

- Implement strong vendor risk assessment models to ensure constant compliance with U.S. regulations.

Changing compliance standards

Every time a fintech business releases a new application or presents a new service or product, there are new regulations that go into effect which perhaps were not realized before. Simply adding a feature to a particular application can alter what they have to abide by in terms of regulations.

Actionable tips:

- Make sure your systems have a modular architecture so they can be quickly modified to comply with new laws without requiring a total overhaul.

- Partner with software vendors that proactively implement new compliance standards.

- Invest in RegTech by implementing systems that offer automatic compliance checks and real-time regulatory updates.

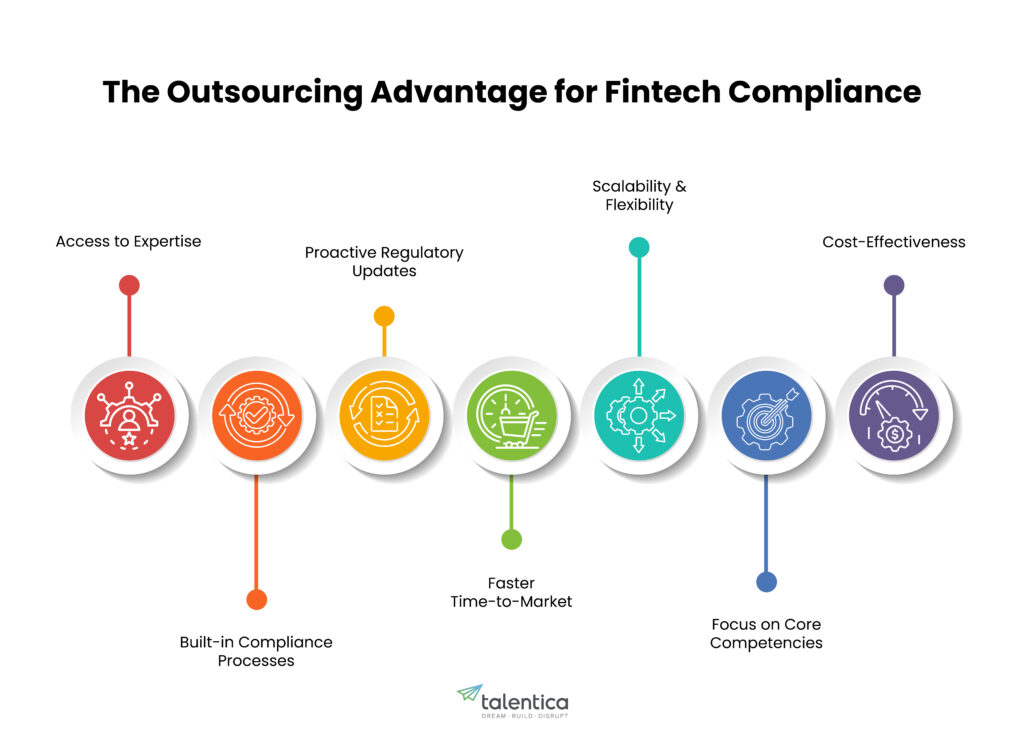

The outsourcing advantage to fintech compliance issues

Outsourcing is not just a cost-cutting strategy for many US fintechs; it is also a strategic factor that helps them bridge the gap between strict fintech compliance and rapid innovation. Fintech organizations can benefit from operational efficiency and specialized skills by outsourcing specific tasks.

Access to expertise

Working with companies that specialize in fintech software development gives you instant access to teams that have deep knowledge of cybersecurity best practices and U.S. compliance standards. This knowledge is essential for managing changing regulations and ensuring your products are market ready.

Built-in compliance processes

The ideal outsourcing partner integrates existing compliance protocols directly into the development process. This means that your software is built with regulatory standards in mind from the start, reducing the chance of having to make costly modifications later on.

Proactive regulatory updated

Leading vendors closely monitor the regulatory landscape and ensure that any CCPA/CPRA revisions, new anti-money laundering regulations, or consumer protection enhancements are quickly included in their product roadmap. This proactive approach reduces regulatory risk and downtime.

Faster time-to-market

Leveraging an outsourcing partner with proven compliance capabilities accelerates your development cycle. Instead of reinventing the wheel, you can focus on core innovation while the vendor ensures compliance is never compromised.

Scalability and flexibility

Outsourcing allows you to scale up or down your development resources in response to regulatory changes or market needs. This adaptability is especially essential in the volatile U.S. regulatory environment.

Focus on core competencies

Delegating compliance and development details to expert partners allows your own teams to focus on driving innovation, creating new features, and improving the overall customer experience.

Cost-effectiveness

Outsourcing offers a significant economic benefit for fintech companies, where every dollar counts. Instead of developing a huge and expensive internal workforce, you can access specialized skills as needed. This technique reduces the high costs of hiring, training, and ongoing payment, allowing you to focus your efforts on growing your core business.

Conclusion

For U.S. fintech companies, staying compliant in a rapidly changing regulatory environment is a challenge as well as an opportunity. By addressing key fintech compliance issues —from data security and KYC/AML compliance to vendor risk and regulatory agility—fintech CEOs can protect their businesses against legal and financial risks.

Additionally, by leveraging the advantage of outsourcing, fintech companies can combine integrated compliance procedures, gain access to specialized expertise, and accelerate time to market while keeping cost under control.

If you would like to learn more or explore our comprehensive software product development services, please feel free to contact us and let’s secure your future in financial technology together.

FAQs

Why is fintech compliance more complicated in the US compared to other markets?

The US fintech sector has a complex regulatory environment due to overlapping federal and state obligations. The Office of the Comptroller of the Currency (OCC), the Financial Crimes Enforcement Network (FinCEN), and the Consumer Financial Protection Bureau (CFPB) are among the agencies that enforce strict compliance regulations in the areas of data privacy, anti-money laundering (AML), and consumer protection.

Unlike regions with a standardized framework, US fintech companies must continually adapt to the changing legislation specific to each jurisdiction.

How can fintech companies stay ahead of regulatory changes in 2025?

To stay ahead, you need to have a proactive compliance approach. This includes:

- Working with software development companies to monitor regulatory changes and implement updates.

- Automating compliance workflows (e.g., real-time transaction monitoring for AML).

- Hiring legal and compliance specialists with experience in the U.S. financial ecosystem.

- Regular audits and ongoing employee training are also required to ensure compliance readiness.

What are the non-compliance risks for US fintech companies in 2025?

Non-compliance can result in severe financial penalties, operational restrictions, and reputational damage. For example, violations of the Gramm-Leach-Bliley Act (GLBA) or the Bank Secrecy Act (BSA) can result in fines of more than $500,000 per violation, personal culpability for executives, and loss of consumer trust.

With authorities focusing more on digital assets and consumer safety, even accidental mistakes can have long-term ramifications.