The financial sector is evolving at an incredible pace, driven by innovation and regulations. While it brings several benefits, it also presents significant challenges, particularly in terms of security within financial software development. Data breaches in this industry are costly, averaging $5.9 million per incident for financial organizations. This constant threat demands advanced encryption, regular software updates and user education, while balancing security with accessibility, particularly for less tech-savvy individuals like the elderly. Organizations that have applied AI and automation to security have seen significant reductions in breach costs, saving an average of USD 2.22 million compared to those that didn’t deploy these technologies.

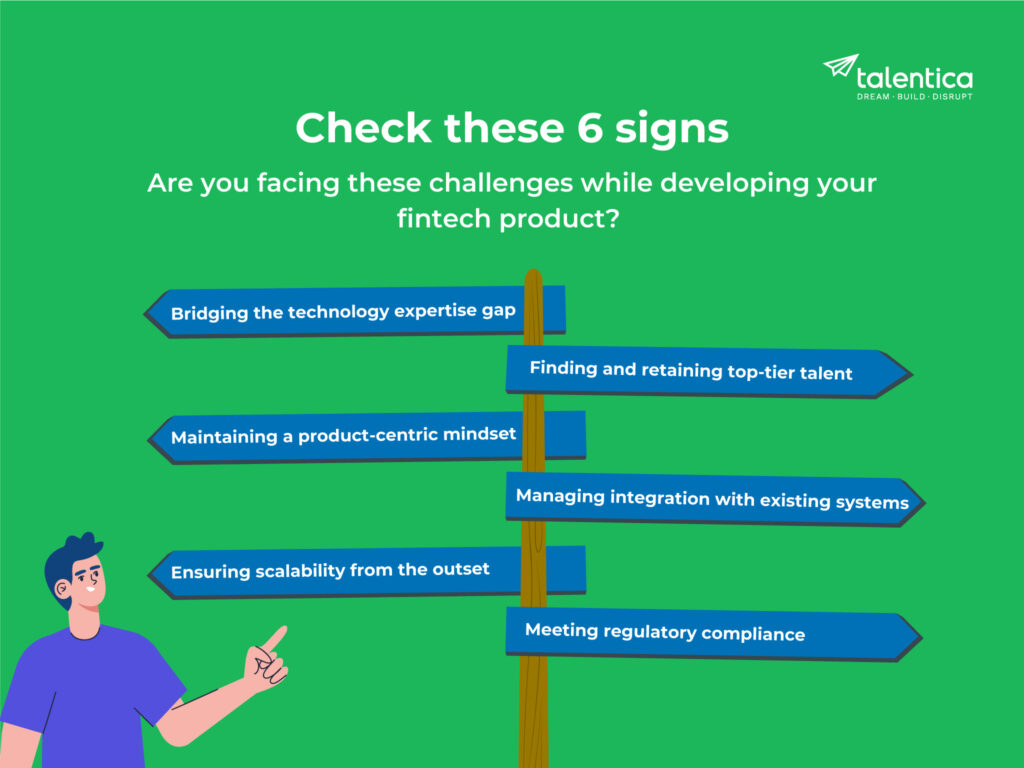

However, developing or modernizing or integrating AI into financial software is not an easy task. It requires a careful mix of technology, design, and business know-how. Challenges include keeping up with rapid tech changes, attracting top talent, maintaining a product-centric focus, and managing scalability, compliance, and integration issues.

Drawing from our experience with several fintech products, in this article we offer insights into the challenges encountered and strategies to overcome them. We have also highlighted important factors to consider when developing financial software, along with an overview of the associated costs. But before we dive in, let’s establish the groundwork.

What is financial software development?

Financial software development involves building applications that help individuals and businesses manage their finances effectively. These applications include banking software, trading platforms, payment processing systems, and accounting software. The goal is to provide consumers with a seamless, easy-to-use experience while keeping their financial information safe and secure.

Potential challenges in financial software development

Bridging the technology expertise gap

Companies, as they expand, try to integrate new technologies like AI, blockchain, and advanced data analytics to increase their productivity and optimize operations. However, their lack of technical expertise can lead to issues like delayed development and hindered innovation, significantly raising the risk of failure.

You can address this by building an in-house team with a blend of financial and technological expertise or by partnering with companies that specialize in fintech solutions. Combining financial insight with technical skills creates a dynamic and innovative environment. This collaboration fosters continuous learning and adaptation, allowing teams to navigate complex technologies and develop solutions that align with both industry goals and consumer needs.

For example, one of our clients, a leading digital fintech platform, had a great opportunity to build and launch a new technology product to meet growing market demand. However, they faced tight deadlines and a limited engineering team. We streamlined their processes, filled the skill gaps with our expert engineers, and fostered seamless collaboration to overcome these challenges. The result? A successful launch of their entire product in just 5 months! See the full success story here!

Finding and retaining top-tier talent

Finding and retaining top-tier talent with the specific expertise required for financial software development is a challenge in itself. Competition is strong, and without the right team, your project may not reach its full potential.

Instead of relying entirely on traditional hiring techniques, consider collaborating with organizations that specialize in financial software development or tapping into a global talent pool through outsourcing. This will help you get the skills you need without having to deal with local talent shortages. For a more in-detailed guide you can check out article on 3 Steps to Hire an Offshore Software Development Teamoffs

Maintaining a product-centric mindset

It’s easy to get bogged down in the technical details of financial software development and lose sight of the end goal– creating a product that meets consumer demands. User-centered design is critical, but maintaining this mindset can be difficult when dealing with competing priorities and numerous complexities.

So, what’s the solution? Adopting a user-centered design approach is critical to ensuring that the software remains intuitive while retaining core functionality. Regular user testing and feedback is critical to achieving the right balance of power and ease of use.

Additionally, having a strong product management team that understands both the technical aspects and what people want is critical to keep project moving forward in alignment with the overall vision.

Managing integration with existing systems

Integrating new financial software with legacy systems can cause significant bottlenecks in the development process. Given the complicated terrain of the financial industry, many firms find themselves relying on a complex web of outdated systems, making it difficult to implement new solutions.

Ensuring compatibility is essential; thus, an in-depth assessment of your current systems’ capabilities and limitations is critical. Designing software for seamless integration helps reduce disruption for end users while ensuring smooth operation. Collaboration with third-party vendors or technology partners can also be necessary to align various components effectively.

For example, one of our clients, a California-based fintech company, was struggling to meet the growing demand for their digital mortgage platform. They teamed with us to expand their engineering team and streamline their processes. Our middleware solution simplified integrations with banking systems, reducing onboarding times and increasing customer adoption. This successful collaboration enabled the fintech company to meet customer needs and stay on track with their product roadmap, paving the way to reach their next milestone. See the full success story here!

Ensuring scalability from the outset

Financial software must be developed keeping growth in mind. What works for a handful of users might not work for thousands or millions. As your user base expands and transaction volumes increase, scalability becomes a critical challenge. If not planned in advance, scaling can lead to performance bottlenecks and technology debt.

By adopting scalable architecture from the start, such as cloud-based solutions or microservices, you can ensure that your software grows at the same pace as your business. Also, regular monitoring of system performance and user behavior allows for rapid modifications, preventing disruption and maintaining the user experience.

Also read: 4 tech debt pitfalls your startup needs to avoid

Meeting regulatory compliance

The financial industry is one of the most heavily regulated sectors, and non-compliance can lead to hefty fines and reputation damage. Keeping your software up to regulatory standards is a constant challenge. It would be better to integrate compliance into your development process right from the start.

By teaming up with legal and compliance experts, you make sure your software ticks all the regulatory boxes, avoiding expensive fixes later. Bringing compliance into the project early and keeping experts in the loop at every stage helps cut down risks and boosts confidence in your product. Plus, regular check-ups and updates in response to changing rules are also critical in maintaining compliance, thereby safeguarding both your organization and its clients.

Structuring your financial software development process

Structuring your financial software development properly is important. Here’s how you can do it:

Choosing the right features for your financial software systems

Choosing the right features is essential to maximizing the ROI of your software and ensuring it has the features you want.

Here are the important features to prioritize:

Security first: Use strong security mechanisms to protect private information, such as intrusion detection, multi-factor authentication, and encryption. Ensure adherence to relevant regulations like PCI DSS, SOX, and GDPR to avoid legal complications.

Real-time data processing capabilities for informed decisions: With real-time data processing, you can analyze your finances dynamically. Make quick judgments based on current data to enable faster reaction times to market changes.

Intuitive and easy user experience: Prioritize a user-friendly interface. Make it simple to use and include elements like drag-and-drop functionality to empower non-technical people.

Data-Driven Insights: Use in-depth data analytics and reporting to enable informed decisions. Provide detailed reports on cash flow, costs and revenue. Adapt these reports to get insights tailored to your business needs.

Smooth system integration: Make sure your financial software can integrate with other business applications you use, such as payroll, CRM, or ERP systems. This reduces the need for human data entry and optimizes procedures.

Flexible and scalable: The software must be adapted to meet the growth of your business. Look for features that help handle growing data volumes, add more users, and meet future requirements.

Selecting right tech stack for financial software development

Once you’ve determined what features your financial software should have, let’s look at the technology stack that can bring them to life. Here’s a breakdown:

| Component | Description | Benefits | Examples |

|---|---|---|---|

| Programming languages | Language used to write the code for your software. | The choice depends on the needs of the project. Consider readability, data science capabilities, and enterprise suitability. | Python (readable, data science) Java (enterprise applications) C# (.NET applications) |

| Frameworks and Libraries | Pre-built code modules that accelerate development. | Faster development time. Standardized coding practices. | .NET (Microsoft, various applications) Django (Python web framework) |

| Database Solutions | Where your software stores and manages data. | Efficient storage and management for large data sets. Choose based on data structure (structured or unstructured). | SQL databases (MySQL – structured data) NoSQL databases (MongoDB – unstructured data) |

| Cloud Platforms | Scalable, cost-effective infrastructure for software deployment and management. | Easy adjustment of resources based on usage. Scalability for growth. | AWS (Amazon Web Services) Azure (Microsoft Azure) |

| Advanced technologies | Optional features for enhanced functionality. | Automate tasks, personalize experiences, and gain deeper insights. Consider blockchain for specific security or traceability needs. | AI & Machine Learning (fraud detection, risk management) Blockchain (secure transactions) |

A step-by step guide to financial software development

This development journey can be broken down into several key stages.

Understanding your needs: Collaborate with stakeholders to gather detailed insights into your needs and target audience. Identify and prioritize core features, making sure everyone involved is on board from the start.

Designing the application architecture: Design the application architecture only when you have a clear vision. Choose databases, frameworks, and programming languages that are needed, and implement strong security measures from the start. Scalability should also be a significant consideration to ensure the design evolves as your company expands.

Development and testing: Build the product one feature at a time, testing thoroughly to identify and resolve any issues. Before moving on to the next level, do rigorous quality control to ensure that the program functions well.

Launch and beyond: Once the software is ready, deploy it to your preferred platform (on-premises or in the cloud). After launch, continue to troubleshoot and provide updates to ensure the software runs smoothly over time.

To maximize the potential of your financial software, consider implementing artificial intelligence.

Empowering your fintech software with AI

Financial institutions are adopting AI at a rapid pace; more than two-thirds use it solely for data analysis. By 2027, the financial sector is expected to spend approximately three times as much on AI, indicating that this trend is not slowing down. Here are the four key areas poised for substantial investment.

Fraud detection and prevention:

Artificial intelligence is particularly effective at quickly assessing large volumes of data, helping to detect unusual trends and possible fraudulent activity before they occur. This means your business and its software users will benefit from a more secure financial environment. Citrus Pay, one of our fintech clients, improved the payment system by implementing AI. Check their success story.

Chatbot-based AI streamlines customer support:

Chatbots can efficiently answer standard customer queries, freeing up human agents to work on more complex issues. This not only improves customer satisfaction but also increases operational efficiency.

Predictive Analytics for Data-Driven Forecasting:

Generative AI is rapidly transforming the finance sector, with substantial growth anticipated in the coming years. [J P Morgan]. This technology enables the generation of precise financial projections by leveraging historical data and market trends, empowering users to make well-informed budgeting and investment decisions with confidence.

Personalized Financial Advice:

AI can provide personalized financial advice by analyzing user data, such as financial goals, spending habits, and risk tolerance. This encourages a user-centric experience and empowers people to make wise financial decisions.

Cost considerations for financial software development

Financial software development requires careful planning. Costs can vary significantly depending on several factors, including:

Project Complexity: Software cost increases with the number of features, integrations, and complex logic your software has.

Development Team: The location, experience, and level of expertise of your development team have a big influence on costs. Generally speaking, hiring developers’ in-house costs more than outsourcing to regions like India where rates are lower.

Technology Stack: The most advanced technologies such as artificial intelligence and blockchain implementation can be expensive. For critical roles, traditional techniques might be more economical.

Strategies for optimizing cost in financial software development

Several strategies can help you optimize costs:

- Prioritize features: Pay attention to essential features first, then make improvements. This helps control startup expenses.

- Embrace agile development: This approach minimizes costly rework by allowing for regular contributions and reviews.

- Automate testing: To save time and money on manual testing, use automated testing technologies.

- Plan and analyze requirements: To establish the project scope and avoid costly changes later during development, proper upfront planning and requirements analysis is essential.

- Select the best development methodology: Agile development encourages flexibility and faster iterations, making it easier for you to adapt to changing requirements more efficiently.

- Optimize your development team structure: Depending on your project requirements, you can choose to combine in-house expertise, hire freelancers for specialized talent, or outsource to regions with lower development costs.

- Use open source and pre-existing solutions: To reduce expenses and development time, take advantage of pre-built libraries and frameworks whenever possible.

- Implement strong quality assurance (QA) procedures: Strict quality assurance procedures identify errors early on, avoiding costly corrections later.

- Adopt DevOps practices: DevOps allows development and operations teams to work more closely together, leading to faster deployments and increased productivity.

- Maintain clear communication: Having open and honest lines of communication with your development team helps minimize misunderstandings and rework by keeping everyone informed.

- Focus on continuous learning and improvement: To maximize profitability throughout the life of the project, stay current with emerging technologies and development methodologies.

- Maintain clear communication: Having open and honest lines of communication with your development team helps minimize misunderstandings and rework by keeping everyone informed.

- Focus on continuous learning and improvement: To maximize profitability throughout the life of the project, stay current with emerging technologies and development methodologies.

Also Read: 8 Proven IT Cost Reduction Strategies

Consider development options: in-house or outsourced

There are two main ways for financial software development: creating it in-house or outsourcing it to a financial software product development company.

| Factor | Consideration | In-house development | Outsourcing development |

|---|---|---|---|

| Team | Existing skills | Ideal for projects that match your team’s expertise. | Gain access to more experienced fintech software product developers, some of whom may have unique skills that you don’t currently have in-house. |

| Project requirements | Project scope and duration | Suitable for major, long-term projects that require dedicated resources. | Ideal for one-off initiatives or projects requiring variable resources. Allow internal staff to focus on key responsibilities by outsourcing specific development tasks. |

| Budget | Cost considerations | Higher initial expenses for employment, infrastructure and tools. | Outsourcing can save you money, especially if you don’t have the necessary expertise in-house. You eliminate the hiring, training, and infrastructure expenses of building an in-house team. To get the best deal, keep agency costs in mind and work with a trusted vendor. |

| Company culture | Development philosophy | Ideal for projects that match your company’s culture and development style. | Although cultural differences may occur, appropriate vendor selection, based on demonstrated experience and communication style, can reduce these risks. |

| Control level | Communication and oversight | Ideal for critical tasks that require complete control and close communication. | Less control over the development process but strong communication protocols and project management technologies can help resolve it. |

| Security | Data protection | Low security risks with an in-house team. | Increased vigilance when it comes to data security is essential. Partnering with experienced outsourcing organizations with strict security policies reduces risk. |

Note: Craft a development strategy tailored to your specific needs and goals. While outsourcing offers a cost-effective way to develop secure, high-quality fintech applications, fast-tracking your time to market and tapping into specialized expertise, the success of your product depends on a team that shares your vision and goals.

However, selecting the right development partner is critical to project success.

Choosing the right financial software development partner

Here are few factors to consider before making this decision:

Technological experience

The right development partner possesses strong technical skills. When choosing a development partner, ensure they have deep expertise in the latest technologies and tools essential for cutting-edge financial software development. This involves knowledge of blockchain, cybersecurity protocols, artificial intelligence and data analysis. Their ability to efficiently use these technologies can impact the robustness, security, and efficiency of your financial software.

The best talents

Selecting a partner who has top talents in their team is critical. This includes not only talented developers, designers and engineers, but also those with experience in the financial industry. A team that understands the specific issues and regulatory needs of financial software development is more likely to provide a solution that meets your expectations. Look for partners who invest in ongoing training and development for their employees to ensure they stay up to date with industry trends.

Product mindset

Instead of focusing solely on task completion, the right development partner focuses on user experience and overall product success. They should be able to understand your company’s goals and translate them into an easy-to-use product. This includes iterative development, user testing, and dedication to improving the program based on feedback. A partner with a product mindset will work collaboratively with you to develop a solution that meets your demands and those of your consumers.

Innovation focus

In the fintech industry, innovation is key. Your development partner should be proactive, staying ahead of future technologies and ready to experiment with new ideas to keep your product competitive and cutting-edge. Innovation should also serve a purpose, delivering tangible value rather than being pursued just for the sake of it.

At Talentica, we have upheld this principle since 2003. Our engineers, selected from India’s top 2% talent pool, operate with a product-mindset that is aligned with the product vision. This ensures that every innovation directly impacts either the top line or bottom line of the customer, delivering measurable results.

Conclusion

Remember that successful financial software development demands a strategic approach, a competent development team and a willingness to innovate. By carefully considering the challenges and following a structured development process outlined in this article, you can create software that meets the evolving needs of your target audience and drives your business forward.

Contact us today to discuss your project and learn how we can help you achieve your goals.